What is Retained Earnings and Opening Balance Equity

Content

It is best to transfer opening balance equity accounts to retained earnings or owner’s equity accounts. If the journal accounting entry amount doesn’t match your bank statement, and you close it out, then the software will adjust the opening balance equity account balance. You can then create an expense entry that includes the inventory item, quantity and rate for proper accounting. Ideally, the account credited would likely be an opening balance equity account. This account’s balance will temporarily feature the $150 to match the opening balance of the bank where the money is deposited. Balance Equitymeans – the consolidated equity according to the international finance reporting standards , and including minority rights, capital note and shareholders loans.

What are 5 examples of equity?

What are Equity Accounts? There are several types of equity accounts that combine to make up total shareholders' equity. These accounts include common stock, preferred stock, contributed surplus, additional paid-in capital, retained earnings, other comprehensive earnings, and treasury stock.

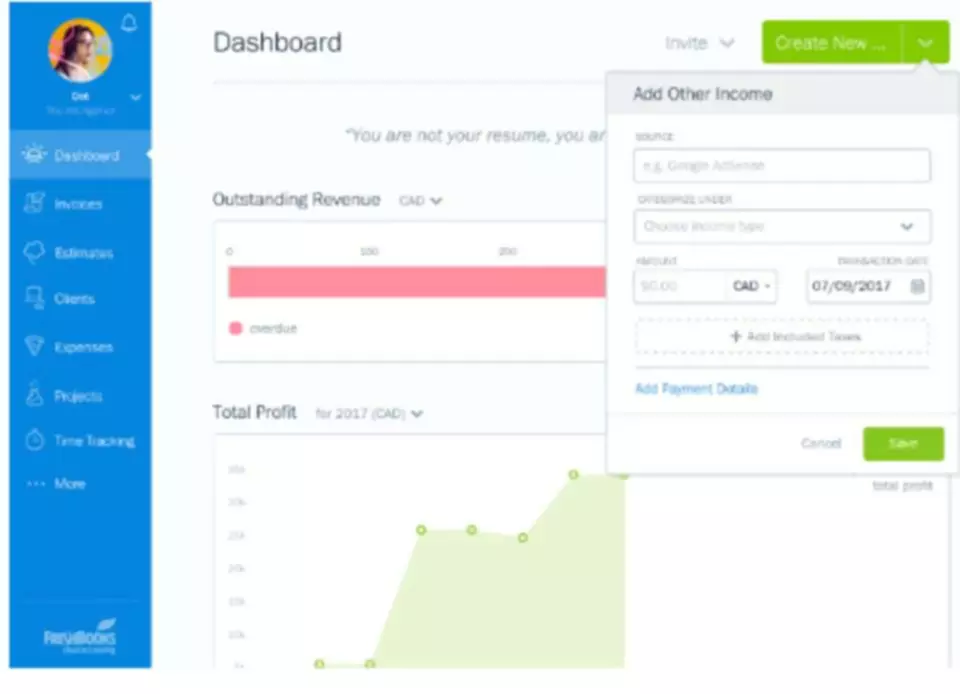

In the https://www.bookstime.com/ process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. You need to click “Start” to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the type you want to export, like lists, transactions, etc. For instance, outstanding balances leads to accounts receivable opening balance.

Opening Balance Equity 03

Opening balances entered when New Customers or Vendors are set up. What should you do if you are working on a massive QuickBooks Online cleanup and you come across a mysterious balance in an account called Opening Balance Equity on the balance sheet? You probably won’t recall ever adding that account to QuickBooks Online, or categorizing any transactions to/from it. Keep reading and I’ll answer those questions and discuss how to clean up Opening Balance Equity in QuickBooks Online. For selecting the file, click on “select your file,” Alternatively, you can also click “Browse file” to browse and choose the desired file. You can also click on the “View sample file” to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields.

She will use Opening Balance Equity as the Adjustment Account for this adjustment-only. The Inventory Adjustment will credit the Inventory Asset account and debit the Opening Balance Equity Account. Since she is adjusting the quantity posted during the New Item Set-up which wasn’t assigned to any “class” her adjustment won’t need a class assigned to it. Now, reconcile the opening balance journal entry for each account through mini reconciliation, a process to do it. When you enter balances from the beginning of the year, then you can enter balance for the previous year’s retained earningsinstead of entering each income, expense and cost of goods sold.

I’m confused, how do you use Opening Balance Equity?

If you want to clear your Opening Balance Equity, you can create a clearing account and transfer the money on it. Hi Courtney, yes you would zero out opening balance equity account and adjust it to retained earnings. Then immediately go back to your balance sheet, and make sure it zeroed out. The opening balance equity should be closed out to retained earnings.